A high-volume semiconductor chip fab would bring new export and high added-value jobs to Finland. The added value staying within the country is many times higher in semiconductor industry than in lower-end industries. When technology is both developed and commercialised in Finland, intellectual property rights also remain in Finland.

Read the summary

- Advanced semiconductor fabs require significant investments and Finland's stable societal structure, access to renewable resources, and skilled workforce make it an attractive location.

- Collaborating with innovation hubs and strengthening domestic development can aid in transitioning research into commercial production, sustaining Finland's contribution to the global microelectronics sector.

- Addressing the global competition for semiconductor leadership requires Finland to provide substantial incentives and partnerships to draw advanced CMOS and specialised microelectronics manufacturing.

This summary is written by AI and checked by a human.

Semiconductor chips are central to the operation of today’s digital society, shaping its functionality. Since the invention of the transistor in the 1940s, chip technology has advanced significantly. With CMOS technology, computing efficiency increases the more transistors are integrated onto a single chip.

As technology advances and we need to transmit, send and handle growing amounts of data, more efficient computing solutions are needed. Moore’s law—which predicts transistor counts will double every two years—is now in doubt. With 2-nanometre processors in fab and the 10-Angstrom technology being developed, the laws of physics slowly start to limit the development. Therefore, new transformative and alternative computing approaches are needed.

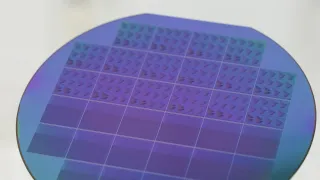

Chip fabrication technology and equipment are continually advancing, requiring ongoing investments in the development of new technologies. Updating hardware is necessary to develop chips for future generations of technology. Around the world, major semiconductor companies are investing significant amounts in new advanced semiconductor fabrication fabs. These fabs will be able to produce enormous quantities of wafers and components each year and they can cover areas equivalent to several football fields. Governments provide subsidies for these projects, which influences the investment choices of large corporations. Global competition for technological leadership remains strong, affecting countries worldwide.

During the research and development phase, innovation hubs, including Micronova and the upcoming Kvanttinova, research institutes, leading university research units, and related industries, provide an excellent framework for developing, piloting and testing new technologies. Technologies created within these hubs can be transitioned to volume production to commercial semiconductor fabs as demand increases. To facilitate this process, manufacturing facilities are needed in Finland to bring research outcomes to the market. Developing and commercialising technology domestically also keeps intellectual property rights within Finland.

Semiconductor fabs consume significant amounts of energy, water, and materials. As the semiconductor industry increasingly considers sustainable development, the importance of having access to renewable energy and water has and is growing. In Finland, there is relatively easy access to these resources compared to many other regions, including parts of Europe, Asia, and the United States. Additionally, Finland faces a lower risk of natural disasters and has a stable societal structure. These factors contribute to a supportive environment for the semiconductor industry.

The most advanced processor technologies are currently concentrated in Asia and the United States, with limited presence in Europe. From a technological self-sufficiency standpoint, this presents challenges for our region. Due to the complex requirements and lengthy development timelines associated with these technologies, attracting CMOS manufacturing to Finland would be difficult without substantial incentives. Even with such incentives, success would require offering unique advantages not readily available elsewhere. Therefore, it is essential to develop long-term partnerships to secure access to cutting-edge processor technologies.

Finland has a longstanding history in the development, research, and commercialisation of specialised microelectronics, including RF technologies, new memory options and materials, MEMS, power semiconductors, integrated photonics, quantum technologies, and microfabrication integration technologies that support the production of increasingly complex modules and new types of miniaturised technological solutions. In these areas, Finland is able to make notable contributions and influence the sector on a global scale. These technologies could also have the best potential to be manufactured in Finland in large volumes, supporting technological sovereignty in the Europe.

Microchip fabrication facilities require a highly skilled workforce. Finland's robust education system effectively prepares professionals to this industry. Advanced research conducted at universities and research institutes supports the development of innovative technologies for specialised microelectronics. Establishing manufacturing operations in close proximity would facilitate the efficient industrialisation and transfer of these technologies to large-scale production. Finland’s manufacturing environment and possible cost structure could be better suited for specialized microelectronics as that field is not yet that competitive as for example standard logic circuits.

The current geopolitical climate has prompted nations to compete for semiconductor fabrication through various subsidies and incentive schemes. Accordingly, it is essential that the government also demonstrates readiness to attract chip manufacturing investments to Finland. Companies already have access to investment subsidies and tax incentives. Simplifying the process for recruiting skilled labour, particularly experts, into Finland should also be prioritised. While incentives must be adequate, it is crucial that they are effectively promoted so that companies are informed of their availability and recognise Finland as a competitive location for establishing manufacturing facilities.

Quantum technology is not yet mainstream and is not yet suitable for mass production. In addition, current demand does not justify the construction of large quantum chip fabs. Nevertheless, quantum technology may become important for maintaining competitiveness in the future. Over the next decade, there could be a need for mass production capabilities in this area, as well as in photonics and certain compound semiconductors. Finland has developed expertise in these technologies, which require specialized equipment and skills, and may become involved in their manufacturing on an international scale.

Establishing a highly specialised microelectronics fab could be a potential next objective for Finland. The country possesses the necessary framework and expertise to support such an initiative. Finland also has experience in developing and commercialising advanced technologies. Through coordinated national cooperation and collaboration among universities, research institutes, industry, and authorities, we can certainly attract a semiconductor fab to Finland.